WhatsApp Chatbot for Insurance with Top 13 Use-Cases

WhatsApp Chatbot for Insurance with Top 13 Use-Cases

In this blog, we’ll thoroughly discuss the several use-cases available for WhatsApp Chatbots for Insurance.

Let’s begin with some context.

In the 2009 American sports drama The Blind Side, protagonist Sandra Bullock delivers an oddly specific analogy. She talks about why defenders are an integral part of any sport.

As every housewife knows, the first check you write is for the mortgage, but the second is for the insurance.

Such is the reach of insurance in our lives.

In America alone, insurance-related activities contributed $602.7 billion to the country’s economy. This equates to an unbelievable 3.1% towards the USA’s GDP.

LIMRA’s 2018 Insurance Barometer Study states that 60% of people in the United States were covered by some type of life insurance.

To understand the importance of the internet towards this venture, consider this-

- Half of all adults visited an insurance company website and/or sought insurance information online.

- Almost 1 in 3 purchased life insurance online — about the same as in 2017.

Suggested Reading: WhatsApp Business Policy Change: All You Need to Know

India – home to Insurtech

Even in an internet-growing country like India, the insurance industry is a great bet to make.

And, banking on this US$ 94.48 billion bet are “insurtech startups.” Backed by investor confidence and securing new-age technology.

These startups, sometimes worth hundreds of millions of dollars are all the rage.

Companies like PolicyBazaar, Digit Insurance, Acko, Coverfox, TurtleMint, and OneAssist are all looking to help India’s 220 million-plus policy-holders buy and manage insurance better.

The problem

Unlike in eCommerce and real estate, insurance is not a “prettiest one wins” type of purchase.

As you don’t necessarily win over customers by having the prettiest website. Or even the most well-known brand ambassadors. Even though those two factors may play a part.

In insurance, you win by achieving an excellent customer experience, providing inexpensive premiums. Not to forget, delivering prompt service and communicating real value.

And most importantly, acknowledging claims – on time and anywhere.

Mostly, this problem arises when companies try to meet these goals. But are unable to do so because of the limitations of existing technology.

In a world where customers can talk to their friends and family in >5 seconds, a business taking 24 hours to respond to a basic query is nothing short of a crime.

Websites, forms, emails and call centers are all miserable at delivering quick, easy or acceptable customer support.

Websites and forms are static elements. They’re unresponsive. By virtue of which, both see single-digit conversion rates. The average fill-through rate for forms is 1%.

The average conversion rate for websites is 2.95%. Indicating, 97.05% of all customers who visit the ‘average’ website, have a flawed digital experience.

Emails are rather slow. The odds of qualifying a lead drop is 400%. That is if they’re not contacted in 10 minutes. But, the average TAT for email support is 24 hours.

Phone calls have been assigned to the backseat of customer support for years. Owing to long queue times, inconsistent service and spammy exploitation. Not to mention, that manning a 24/7 support staff filled with humans is an expensive effort.

Suggested Reading: Customer Support Automation and It’s Importance

The solution

Insurance companies need is a tool that’s-

- Quick

- Intuitive

- Personalizable

- Inexpensive

- Available 24/7

- Scaleable

- Easy to monetize.

This is a tough ask. So what’s the answer?

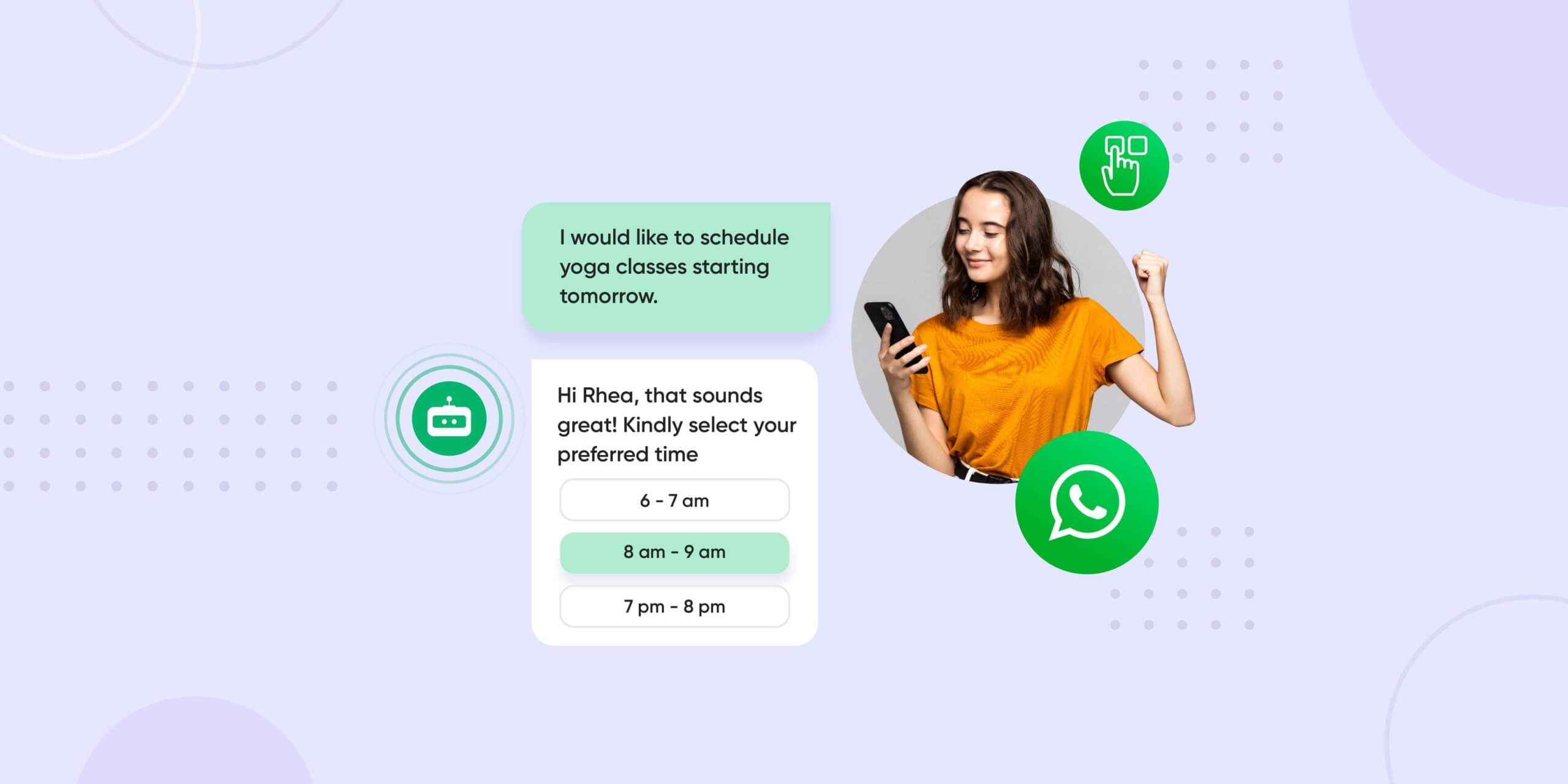

WhatsApp chatbots for insurance

India itself has over 400 million monthly active users. WhatsApp is the most productive communication platform known to man.

From agents to customers, everyone uses WhatsApp.

Hence, with WhatsApp’s Business APIs, so can your company.

Using WhatsApp insurance chatbot, you can offer policy selections, claims tracking and premium calculation. This can be done automatically and in a defined process.

In short, a WhatsApp Chatbot for Insurance allows companies to automate several offerings. Thus, making others more seamless.

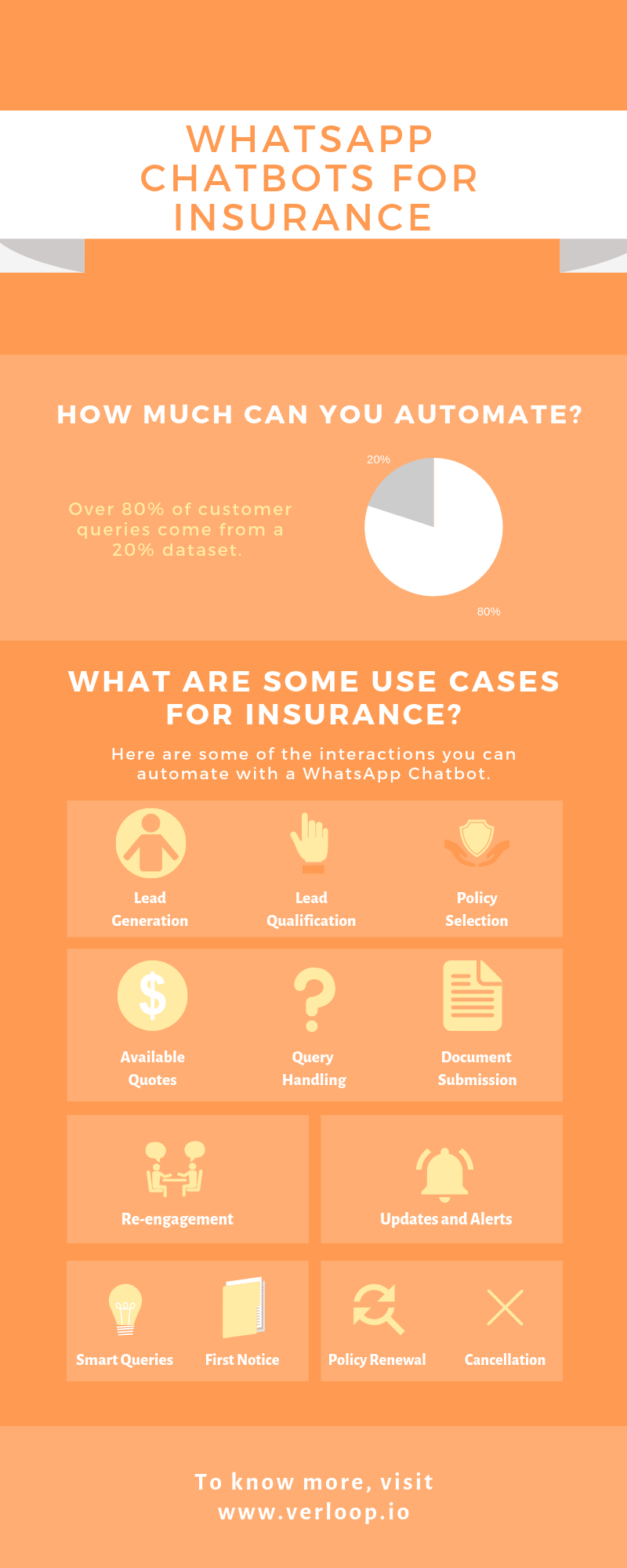

We’ll walk through these 13 Insurance WhatsApp Chatbot use-cases. Charting a customer’s journey through an insurance companies sales funnel.

- Automate Lead Generation

- Automate Lead Qualification

- Policy Selection

- Available Quotes

- Query Handling

- Document Submission

- Automate Updates and Alerts

- Automate Re-engagement

- High-Level Queries

- First Notice of Loss

- Document Submission for Claim Approval

- Intimation of Policy Renewal

- Cancelation of Policy

Automate lead generation

Lead Generation is a top-of-the-funnel sales necessity that plays a huge role in a company’s year-on-year revenue.

As more leads generated gives your sales team more deals to close and better pipelines for the future.

Using a WhatsApp Chatbot for Insurance, you can collect a customer’s name, email, phone number. Or any other information you deem key to the sales process.

Additionally, it is important to note that if a customer texts you first, the system automatically collects their phone number and name.

But, if you plan to use this phone number to send them outbound messages, you have to get them to opt-in.

Automate lead qualification

Lead Qualification is the process of categorizing a lead that you’ve generated to identify what product or service offering matches them best.

But this takes time and effort. Agent resources that could be better spent on more human-required tasks like closing.

In insurance, leads are qualified based on an individual’s monthly salary, any loan undertaken to overpower the premium amount. Or even the premium contribution the person is willing to pay, etc.

Using a WhatsApp insurance chatbot, you can automate this process and have the answers sent to your agents.

Better qualified leads mean that your sales reps have more actionable information. Ensuring that leads are closed quicker.

Automate My Lead Generation Process

Selection of policy

As we mentioned earlier, purchasing insurance is a challenge. There are a lot of factors to consider during the purchase process.

Guide customers to appropriate policies using a WhatsApp insurance chatbot. In doing so, reduce the number of hurdles they face during their sales journey.

Using dynamic logic and deep integrations, a bot can ask your customers questions and use the responses to guide them to a policy that suits them best.

Available quotes

Two major data points that customers consider when buying insurance is the premium and the cover.

In the example below, a customer is interested in car insurance and the insurance bot is guiding them through the process.

It asks questions, collects the necessary information and offers them a list of insurance providers and the quotes.

As we know, the premium amount is always proportional to the cover amount. Higher the cover amount, the higher the premium amount.

Customer support automation

It’s unsurprising that customers have queries during the purchase process for insurance.

What is surprising is how poor of a job companies do in answering them. Insurance chatbots can do wonders in customer support automation.

Query handling is an essential function of converting leads to customers. Users purchase from companies that answer their questions quickest.

If answers to these questions are not readily available, a customer is likely to drop off.

Ensure your customers are well-informed on an easy-to-use interface. Mostly during the sales process.

Instead of having your support team flooded with low-level queries, reduce your support volumes by answering these frequently asked questions.

Document submission

After identifying their desired policy, the next step is the submission of necessary documents.

For instance, the submission of documents is a hurdle in the sales flow process. Customers often struggle because of poor network, incorrect documents, and difficult interfaces.

If documents are not sent in time, application processes will remain on hold. Thereby, delaying the transfer of the insurance title.

Thus, WhatsApp insurance chatbot’s end-to-end encryption allows your customers to exchange documents and other personal information with ease.

Automate updates and alerts

Often, updates and alerts that companies send on email and SMS often go unseen.

Similarly, Insurance companies can reduce their support ticket volumes and improve CSAT/NPS. This can be done by keeping customers updated about the status of their policy through insurance chatbot.

WhatsApp insurance chatbots keep your customers in the loop by informing them where they stand at any given point in time.

Customers can also reply back to you, allowing companies with the ability to cross and upsell to existing companies.

Automate re-engagement

Over 68% of leads generated are lost due to the customers being unresponsive. That is, they fail to reply or upload the required documents.

It is essential for companies to follow-up with customers. But often any outreach on SMS/Email goes unopened.

Boasting, a 100% delivery rate and a 95% open rate, WhatsApp insurance chatbots are the best way to reengage customers.

Reminders on WhatsApp help to convert these lost leads into prospective clients. Hence, receiving information that was left unanswered by them.

High-level queries

We can collectively agree on how WhatsApp insurance bots are extremely qualified to conduct a wide range of activities on its ever-growing platform.

But of course, WhatsApp is yet to acquire the ability to function and think like a human.

Therefore, certain actions and queries need a human touch.

Here, the inability of the WhatsApp insurance bot to answer a query can easily be transferred on to an agent. The agent can continue the conversation in due time.

First notice of loss

The end product of an insurance policy is for the client to demand compensation for the loss undergone by them.

The client can easily pass on this information to the company via the WhatsApp Chatbot for Insurance.

To gather more information about the loss undergone by the client, the company can ask a series of questions.

This helps the company to roughly estimate the compensation amount.

Also, to know if the compensation will be more than the set limit.

After informing the company, the process for calculating the compensation will be undertaken with their own standard procedures.

Document submission for claim approval

Once the employee has given the intimation to the company about the loss sustained, they can submit a series of documents to claim the compensation.

The series of documents that you have to submit will defer from policy to policy. These all are. handled seamlessly by WhatsApp chatbot insurance claims.

Intimation of policy renewal

Prior to the expiration of the policy, WhatsApp Chatbots for Insurance will be able to notify the policyholder about the same.

This gives the clients the window of opportunity to renew their policy before the expiration of the same.

Giving the clients a notice prior to the expiration of their policy is a great way to instill the need to renew their policy.

Cancelling the policy

You can easily communicate to the agent via WhatsApp Chatbots for Insurance. Instead of reaching out to the agent via call or email.

You can simply opt-out of your policy by canceling it when you wish to.

The procedure of cancelation is fairly simple. You have to just converse with the bot regarding the same. And you will be able to cancel in due time.

By canceling the policy abruptly, some amount will be deducted from what you are to receive at the end of the term.

Suggested Reading: Insurance Chatbots In A COVID-19 World

Need for WhatsApp chatbots for insurance

- Clients can easily convey the loss incurred. Or even submit the documents from a single interface.

- Both the agents and the clients will be able to send and receive messages quickly.

- WhatsApp’s end-to-end encryption allows sending sensitive information as well.

- One can easily view the suitable quotes according to their liking instead of visiting the website.

- The feature of “time-saving” is a plus point for both the client and the agent.

- As tons of people already have WhatsApp on their phones. It becomes very easy to send them the necessary information. By this, you can expect 100% readability through conversational ai WhatsApp.

- Agents can now focus on other activities that need more attention.

Knowledgeable and very useful load of infos.